Cryptocurrency has revolutionized the world of finance, offering individuals a decentralized and secure means of transacting value. With its growing popularity and widespread adoption, it is no surprise that many individuals have invested in cryptocurrencies like Bitcoin, Ethereum, or even Crypto.com’s native token – CRO. However, as with any investment, tax obligations need to be considered. As governments around the world catch up with this new digital frontier, it is imperative for crypto investors to understand how to navigate the complex landscape of filing their taxes accurately and efficiently. In this article, we will provide you with a comprehensive guide on how to do your Crypto.com taxes effectively, ensuring compliance while maximizing your returns in this rapidly evolving industry.

Understanding Crypto.com and Tax Obligations

Crypto.com is a popular platform for buying, selling, and storing cryptocurrencies. However, many users may not be aware of their tax obligations when it comes to using this platform. Understanding the tax implications of using Crypto.com is crucial to avoid any legal issues or penalties.

When it comes to taxes, the first thing to consider is that cryptocurrencies are generally treated as property by tax authorities. This means that any gains or losses made from trading or investing in cryptocurrencies on Crypto.com may be subject to capital gains taxes. It is important to keep track of all your transactions and report them accurately on your tax return.

Additionally, if you receive any rewards or staking benefits from holding certain cryptocurrencies on Crypto.com, these may also be considered taxable income. It is essential to research and understand the specific taxation rules in your jurisdiction as they can vary significantly from one country to another. Seeking professional advice from a tax expert who specializes in cryptocurrency taxation can be beneficial in ensuring compliance with your tax obligations while using Crypto.com.

Gathering Necessary Documentation: Transactions and Statements

When it comes to doing your Crypto.com taxes, gathering necessary documentation such as transactions and statements is crucial. Transactions refer to any buying, selling, or trading of cryptocurrencies that you have made on the platform. It is important to collect all transaction details including the date of the transaction, type of cryptocurrency involved, quantity bought or sold, and the corresponding value in your local currency at the time of the transaction.

In addition to transactions, statements are another essential document needed for accurate tax reporting. Crypto.com provides monthly statements that summarize your account activities over a specific period. These statements include important details such as deposits, withdrawals, fees incurred, and interest earned on staking or lending activities. Make sure to gather all monthly statements throughout the tax year so that you have a comprehensive overview of your crypto activities on Crypto.com.

By diligently collecting all necessary documentation including transactions and statements from Crypto.com, you can ensure accurate tax reporting and avoid potential issues with tax authorities.

Determining Taxable Events: Buying, Selling, and Trading

When it comes to determining taxable events in the realm of cryptocurrency, buying, selling, and trading are crucial activities that need careful consideration. Each of these actions can have different tax implications and it is essential for crypto investors to understand them in order to accurately report their taxable income.

Firstly, buying cryptocurrencies is generally not a taxable event itself. However, it is important to keep records of the purchase price as this will be needed when calculating gains or losses upon future selling or trading activities. When an investor sells their cryptocurrencies for fiat currency (like USD), it triggers a taxable event where any gains made will be subject to taxation. On the other hand, if an individual trades one cryptocurrency for another (such as Bitcoin for Ethereum), this also qualifies as a taxable event where any profits or losses must be reported.

To ensure accurate reporting of taxable events related to buying, selling, and trading cryptocurrencies on platforms like Crypto.com, investors should maintain detailed transaction records including dates, amounts involved, purchase prices, sale prices or fair market values at the time of trade. Keeping track of these details will facilitate accurate calculations when determining gains or losses come tax filing season and help individuals remain compliant with tax regulations in their respective jurisdictions.

Calculating Gains and Losses: Cost Basis and Fair Market Value

Calculating gains and losses for cryptocurrency investments requires understanding the concepts of cost basis and fair market value. The cost basis refers to the original purchase price or acquisition cost of a cryptocurrency asset. It is crucial to determine this value accurately as it is used to calculate capital gains or losses.

Fair market value, on the other hand, represents the current worth of a cryptocurrency asset in an open market transaction. It is essential to establish this value at specific times, such as when buying or selling a cryptocurrency or during taxable events.

To calculate gains and losses accurately, one should subtract the cost basis from the fair market value at the time of sale or disposal. If the resulting difference is positive, it indicates a capital gain, while a negative difference signifies a capital loss. These calculations are vital for accurately reporting taxes on crypto investments and ensure compliance with relevant tax laws and regulations.

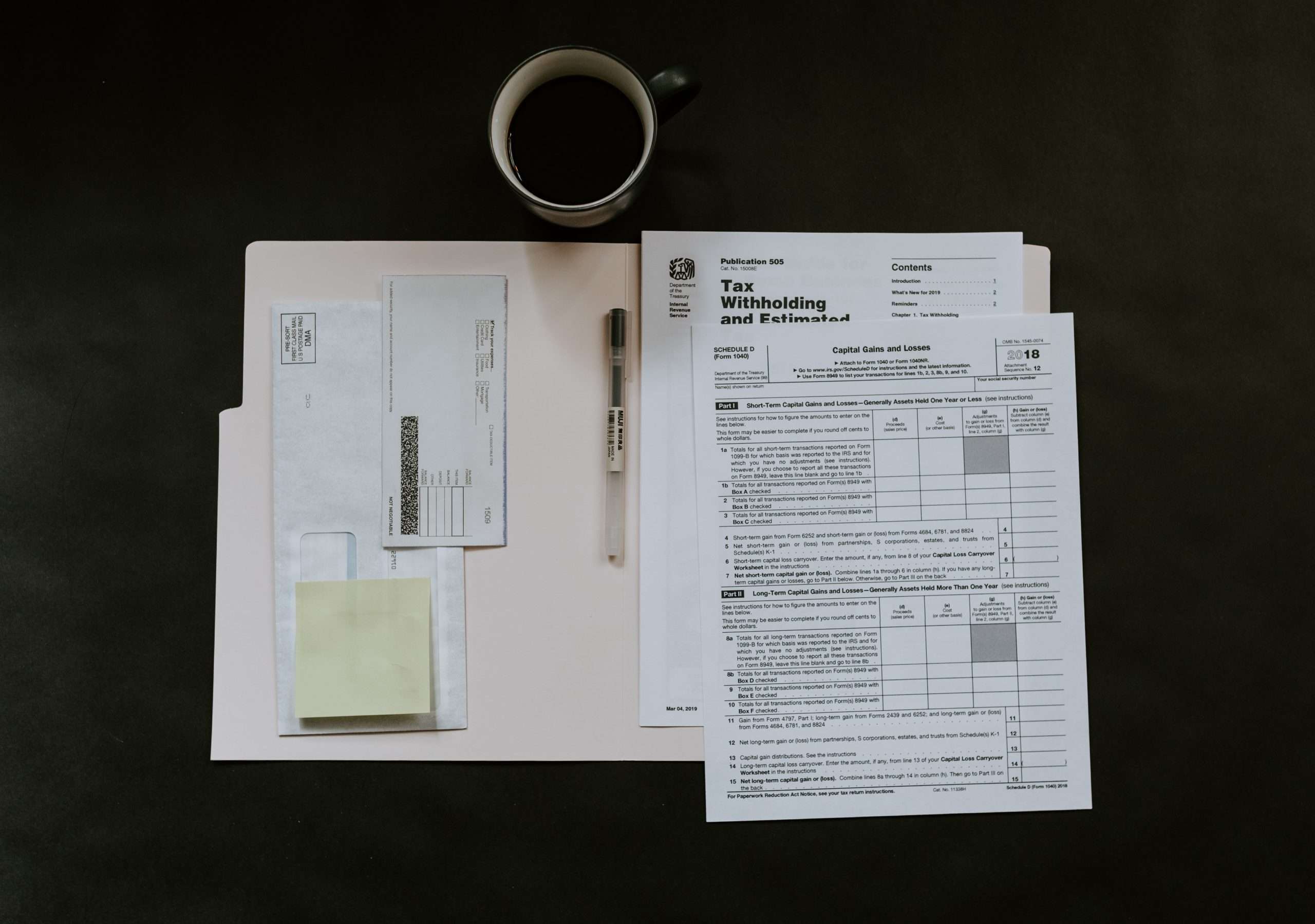

Reporting Cryptocurrency Income: 1099 Forms and Schedules

When it comes to reporting cryptocurrency income on your taxes, there are specific forms and schedules that you need to be aware of. One important form is the 1099 form, which is used to report various types of income, such as dividends and interest. In the case of cryptocurrency, if you receive more than $600 worth of coins or tokens as payment for goods or services, you may need to issue a 1099 form to the recipient.

Additionally, when reporting cryptocurrency income on your taxes, you will likely need to use Schedule D. This schedule is used to report capital gains and losses from investments, including cryptocurrencies. You will need to calculate your gain or loss for each transaction and report the total on Schedule D.

Overall, reporting cryptocurrency income can be a complex process that requires attention to detail. It is important to familiarize yourself with the necessary forms and schedules in order to ensure accurate reporting and avoid any potential penalties from the IRS.

Maximizing Deductions: Expenses Related to Crypto Investments

When it comes to doing your taxes related to crypto investments, maximizing deductions is crucial. One way to do this is by identifying and including all the expenses associated with your crypto investments. These expenses can include transaction fees, exchange fees, mining costs, and even hiring a tax professional or software specifically for handling cryptocurrency transactions.

Transaction fees are charges incurred when buying or selling cryptocurrencies on various platforms. These fees can quickly add up, especially for frequent traders or investors who engage in high-volume trades. By deducting these transaction fees as an expense on your tax return, you can offset some of the costs associated with trading cryptocurrencies.

Exchange fees are another deductible expense related to crypto investments. Similar to transaction fees, exchange platforms often impose charges for converting one cryptocurrency into another or exchanging crypto for fiat currency (e.g., USD). Including these fees as deductions can help lower your taxable income, thereby reducing your overall tax liability.

In addition to direct expenses incurred during trading activities, mining costs also present opportunities for deduction. Mining refers to the process of validating transactions and securing the blockchain network in return for newly created tokens. Expenses such as electricity bills, hardware depreciation, maintenance costs, and even cloud mining contracts can be considered eligible deductions if they were directly related to your mining operations.

Lastly, if you sought professional assistance from a tax advisor or utilized specialized software designed for calculating taxes on cryptocurrency transactions specifically, those expenses should also be included as deductions.

Seeking Professional Help: Accountants and Tax Experts

When it comes to dealing with crypto taxes, seeking professional help from accountants and tax experts can be highly beneficial. Cryptocurrency taxation is a complex and evolving area that requires specialized knowledge and expertise. Accountants who specialize in crypto taxation can provide guidance on how to accurately report your cryptocurrency holdings, transactions, and any applicable gains or losses.

One of the key advantages of consulting with an accountant or tax expert is their ability to navigate the ever-changing regulatory landscape surrounding cryptocurrencies. They stay up-to-date with the latest tax laws and regulations specific to digital currencies, ensuring that you remain compliant while maximizing your tax benefits. With their knowledge and experience, professionals can help you identify potential deductions and credits related to cryptocurrency investments that you might have overlooked.

Additionally, engaging the services of an accountant or tax expert saves you time and reduces stress. Rather than spending hours trying to decipher complex tax forms and guidelines yourself, they can handle all the necessary calculations and paperwork for you. This allows you to focus on other aspects of your financial life while having peace of mind knowing that your crypto taxes are being handled by a qualified professional.

Conclusion: Ensuring Compliance and Maximizing Returns

In conclusion, ensuring compliance with tax regulations and maximizing returns when it comes to Crypto.com taxes is crucial for individuals and businesses involved in cryptocurrency transactions. It is important to stay updated with the ever-changing tax laws and regulations related to cryptocurrencies in your jurisdiction. By doing so, you can ensure that you are accurately reporting your crypto income, losses, and transactions, thereby avoiding any potential legal issues or penalties.

Furthermore, maximizing returns involves taking advantage of available tax deductions and credits that may be applicable to cryptocurrency-related activities. This includes properly documenting all expenses related to mining, trading, or investing in cryptocurrencies. Additionally, exploring different tax planning strategies can help optimize your overall tax liability while staying compliant with the law.

Overall, by prioritizing compliance and diligently managing your cryptocurrency taxes with Crypto.com or any other platform, you not only ensure a peace of mind but also set yourself up for financial success in the world of digital assets. Remember to consult with a knowledgeable tax professional who specializes in cryptocurrency taxation if needed for personalized advice tailored specifically to your situation.